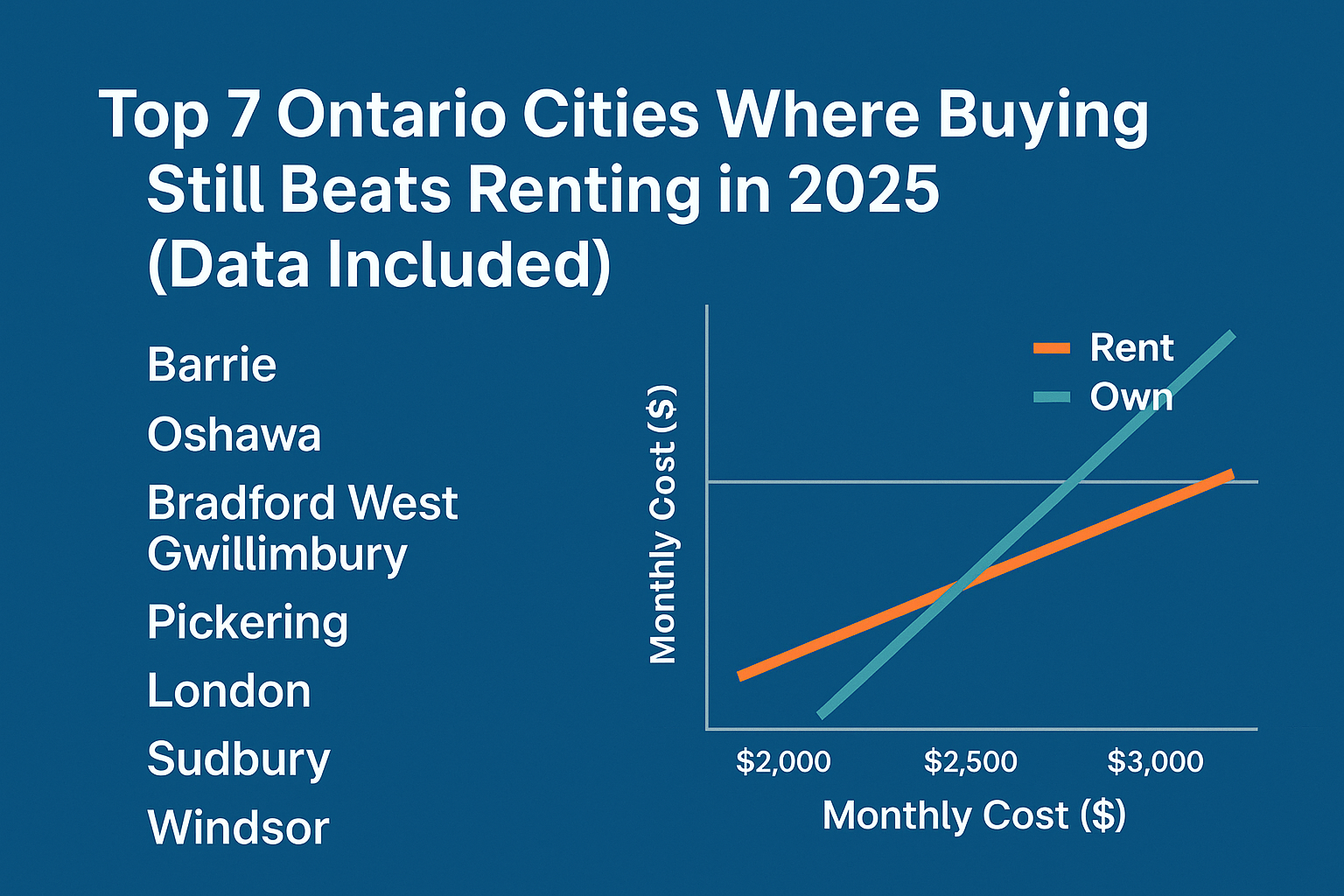

Top 7 Ontario Cities Where Buying Still Beats Renting in 2025 (Data Included)

🏡 Introduction

In 2025, Ontario’s rental market is hitting historic highs — with the average two-bedroom apartment now exceeding $2,650/month. Yet, in several cities, owning a home can actually be more affordable (and build equity faster).

If you’re debating whether to rent or buy, this guide breaks down the top 7 Ontario cities where homeownership still comes out ahead — even in a high-rate environment.

1️⃣ Barrie – Balanced Prices & Rental Income Potential

- Average home price (2025): $735,000

- Average rent: $2,450/month

- Why buying wins: Barrie’s dual-income and rental offset options make it ideal for first-time investors. Many properties allow legal basement suites, reducing net payments by up to $1,200/month.

2️⃣ Oshawa – Commuter City with Future Growth

- Home price: ~$820,000

- Rent: ~$2,700

- Why it stands out: With the Durham transit extension and the GM EV facility expansion, Oshawa is emerging as one of Ontario’s most affordable GTA-adjacent ownership markets.

3️⃣ Bradford West Gwillimbury – Suburban Upside, Family Appeal

- Home price: ~$875,000

- Rent: ~$2,850

- Why buying wins: Legal duplex zoning is common here. Mortgage payments can be offset 30–40% by a basement or in-law suite.

4️⃣ Pickering – Waterfront Growth & Smart Commuting

- Home price: ~$910,000

- Rent: ~$2,950

- Why it stands out: Pickering’s upcoming airport and GO expansion make it a hotspot for appreciation. Renting remains costly, making ownership more strategic.

5️⃣ London – Student City with Long-Term Cash Flow

- Home price: ~$690,000

- Rent: ~$2,200

- Why buying wins: London’s consistent rental demand from students and healthcare workers creates stable returns. Plus, lower property taxes boost ROI.

6️⃣ Sudbury – Low Entry Point, High Yield

- Home price: ~$520,000

- Rent: ~$1,900

- Why it stands out: Investors love Sudbury for its affordability and mining-sector stability. The rent-to-price ratio remains one of Ontario’s best.

7️⃣ Windsor – Affordable Border Boomtown

- Home price: ~$580,000

- Rent: ~$2,000

- Why buying wins: The bridge expansion and Stellantis battery plant have fueled strong employment growth. Owning here costs roughly the same as renting — with long-term upside.

📊 Ownership vs Rent — Monthly Comparison (Example)

ScenarioRentOwn (5% Down, 3.79% Fixed)2-Bed Apt (GTA)$2,850$3,100Barrie Detached$2,450$3,050London Semi$2,200$2,850

Verdict: When you factor in equity growth (avg. 3% appreciation) and rental offsets, ownership becomes more profitable within 18–24 months.

💬 Expert Takeaway

If you plan to stay in Ontario for at least 3 years, buying — especially in growth regions like Barrie, London, or Windsor — can outperform renting. Even if rates rise slightly, you’re building long-term wealth instead of funding your landlord’s mortgage.

🏁 Final Word

The numbers are clear: renting may seem cheaper short-term, but in 2025, the ownership gap has narrowed dramatically. Combine that with flexible lender programs and ADU-friendly zoning, and it’s one of the best times in recent years to buy smart.

📞 Ready to run your rent-vs-buy numbers?

Call (437) 961-0004 or Apply Now